Place your order now and let our writing assistant provide the best content. A good piece of engaging content is all you need to boost up your business sales and we are all about it.

Our Location

- Unit No.10-5A Galleria, Jalan Teknokrat 6, Cyber 5, 63000 Cyberjaya, Selangor. Malaysia

- info@kmwritingservices.com

- +60 383119394

- +60 19 2919412

KM Writing Services offered by KM Software Services

Table of Contents

ToggleIntroduction

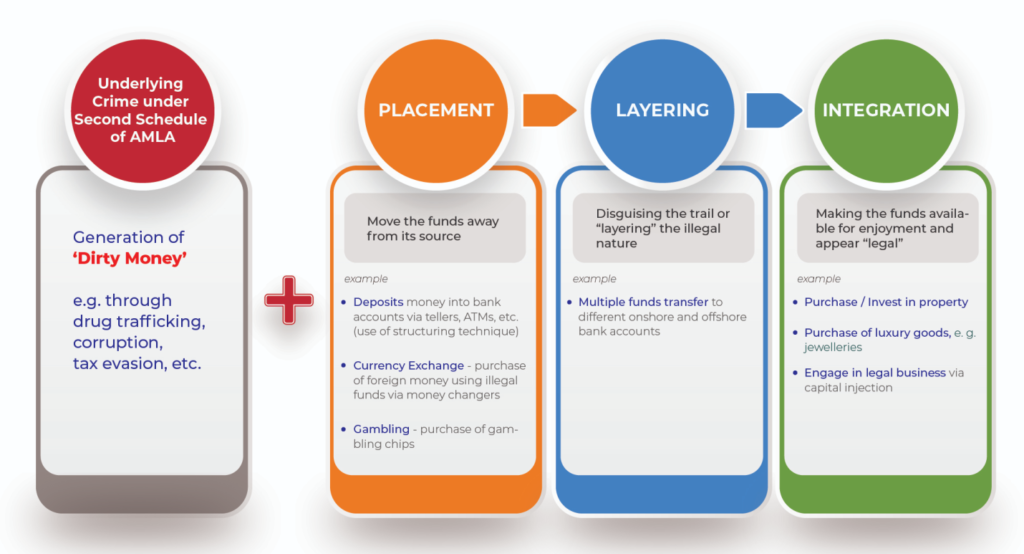

This study is based on two different scenarios where the first one is based on Anti Money Laundering (AML) where John is a newly appointed AML analyst and he has the responsibility of making reports based on suspicious activity and suspicious transactions though these activities are not clear for him. In that scenario, there is a necessity of drafting a clear set of thorough, concise and easily understandable guidance notes on this issue. On the other hand, the second scenario focuses on a member of the AML financial firm in Malaysia who is responsible for making complex business relationships along with signing off high-risk factors associated with the company. In that aspect, there is a need to analyse the client “Global Metal Trading” and make an evaluation of “Customer Due Diligence”. This study has the aim to discuss several risk factors associated with the firm considering current risk appetite.

i) Analyzing the meaning of “Suspicious activity” associated with Anti Money Laundering Process

Defining Suspicious Activity in AML

Suspicious activity is nothing but a disclosure that is being made to the “Financial Intelligence Unit (FIU)”. This is being done based on two different factors and that can either be a terrorist activity or that must be a money laundering process. As per the “Proceed of Crime Act 2002(POCA),” a suspicious transaction is a transaction that is not being made in cash to a person who is acting in a good faith. In that scenario, two factors come in front where the first one might be like the circumstances of unjustified or unusual complexity or that can be proceeding towards crime under suspicion. In the Malaysian context, the country has incorporated “The anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLATFA)”. This law has wide-ranging investigating power along with enforcement where a Public Prosecutor has the authority of freezing and seizing properties that are getting involved or under suspicion.

The Acts associated with the suspicious activity regarding the money laundering process

“Bank Nagara Malaysia”, the central bank of Malaysia hold the authority of making investigations of money laundering cases. These two banks are responsible for making investigations based on the four laws associated with this such as “Financial Services Act 2013”, “Islamic Financial Services Act 2013”, “Money Services Business Act 2011” and “Development Financial Institutions Act 2002 (Act 618)”.

Types of Suspicious Activity in Money Laundering

Money Laundering using Cash

Suspicious activity in the money laundering process can be identified when the transactions are being made in cash the scenarios are as follows.

- This can involve the process of depositing money by misusing night-safe facilities. This way the direct contact with the bank stuff gets avoided.

- If consumers are responsible for making transfers of large amounts of money from foreign countries for payment in cash

- If forged instruments get founded in the deposits of clients

- If a company or person is constantly getting involved in the process of payment through cheques or drafts and suddenly making payment of a large amount of sum via cash.

- If there is a substantial hike in making deposits via cash through an individual and the transfers are very frequent in a short amount of time and the receiver has no previous connection with the sender.

- If the consumer is responsible for the involvement in paying via credit slips with the aim of making all deposits unremarkable and simultaneously all credit significant.

- If a customer cover requests for the transfer of money bankers drafts or other money instruments by making a deposit through cash.

- If the customer is trying to exchange a large amount of “Low denomination notes” with “High denomination notes”

Money Laundering with the help of bank accounts

Suspicious activity in the money laundering process can be identified when the transactions are being made through bank accounts the scenarios are as follows

- If a large number of people are paying in the same account without any appropriate explanation

- In case of any kind of large cash, withdrawal has been made from an account that has received a large amount of sum all of a sudden.

- If the customer is seeking to maintain numerous inconsistent client accounts with the business type

- If any company is responsible for being involved in making disbursement or receiving a large number of sums without any obvious purpose or any particular relationship with the account holder while the account has no business-related activities.

Investment-related suspicious transactions

- Selling or buying securities without any discernible objective.

- Customers are making requests for administration services or investment management with an unclear source of funds.

- Customers are involved in the process of making unusual settlements in the form of cash.

Offshore international activity in money laundering

- Creating a large balance without a consistent previous history of turnover

- Frequent requests for “foreign currency drafts” to be issued.

Unsecured and secured lending in the process of Money laundering

- Customers are repaying problem loans in an unexpected way.

- The customer is making a request for providing finance where the customer’s financial dealing is unclear.

Money laundering by forming a new business

- The client is making a transaction in which the counterparty is unrecognizable or has any valid information.

- The client is showing reluctance in providing valid documents and an unrequired use of an intermediary in the transaction.

- In this case, the dealing pattern is showing “low-grade securities” are being purchased in a constant scenario in a foreign jurisdiction and being sold locally for buying “high-grade securities”.

Real-life Cases associated with money laundering in Malaysia

An example can be added that the case of “Genneva Malaysia Sdn Bhd” in the year 2020 where the company is accused under “section 25(1) of the Banking and Financial Institution Act 1989 (BAFIA)”. And there is “section 4(1) of the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLATFA)” for accepting money from invalid depositors and getting involved in the process of money laundering at the “Kuala Lumpur High Court”. One more case can be added here that is “the case of Dr Hamimah”. He is the first one who gets convicted in the law of AMLATFA as she has been accused of falsifying financial documents and transferring RM42 million in her own account. As a result, Prosecution against the blamed was commenced for eight counts of money laundering violations.

ii) Discussion on Financial Institution Obligation once suspicion gets identified

Procedures for Reporting obligation

Once the suspicion gets identified there is a need for reporting the obligation to the bank of Negara Malaysia. The obligation is being made in two ways either in the form of a “Suspicious Transaction Report” or in the form of a “Cash Threshold report”.

Cash Threshold Report (CTR)

CTR is a report being made when there is a dealer who is aware of the fact that the client is getting involved in the transaction process. In that scenario dealer, who is going to receive the amount is responsible for reporting the transaction in terms of section 28. However, this is done in a few selective institutions only. As per “Section 4A of the AMLA” the violation of making transactions for avoiding reporting CTR a structuring has been involved in Malaysia for splitting up transactions into distinct amounts under “MYR 50,000” per day in order to avoid “CTR transaction reporting” requirements under the AMLA. To this date, CTR reporting obligations get imposed on instruments related to banking several licensed casinos only.

Suspicious Transaction Report (STR)

STR is a report that is being made for submitting to the “Financial Intelligence and Enforcement Department”. The STR is being made in the following cases where there are possibilities of money transferring is being done appears unusual or that no shows no valid economic purpose or that is showing any illegal activity or any kind of relationship towards money laundering or terrorism. This is very important to make STR because this provides valuable and reliable information to “Financial Intelligence” and other law enforcement agencies in order to deal with unlawful money laundering activities.

Reporting Institutions

Reporting institutions are responsible for adopting, developing and implementing internal programmes procedures, policies, and controls in order to guard against any money laundering offence under AMLA. These institutions are responsible for ensuring high standards for evaluating the financial and employment-related history of these employees. Besides they are responsible for making self-sustaining audit functions.

Report legal Obligations with the help of Malaysian Lawyers

In Malaysia, lawyers are responsible for making obligation reports to all the institutions including legal practitioners based on “Part 4 of the AMLATFA”. On the other hand, based on

“Section 14 of AMLATFA 2001” lawyers have the responsibility for filing STR to the “financial intelligence unit (FI)”. Bank Negara has specified FI under “section 8 of the AMLATFA” as referred. Malaysian solicitors and advocates are responsible for prompting any report of any kind of financial suspicious activity as a formation agent of lawful entities.

To whom the report should be made

The Financial has been set up within the Enforcement Department and Financial Intelligence in Bank Negara Malaysia with the intention of managing and providing a wide analysis associated with money laundering activities. This department is responsible for making investigations and receiving STR and works under BNM with 12 overseas and domestic “foreign enforcement agencies”. In the year 2003, “Egmont Group of FIU” provided a forum for making expansion and information exchange regarding financial information. Besides, the police forces such as the “Malaysian police force” and the “Customs Department” also have the responsibility for tracking the unlawful money trail. The “securities commission (SC)” is the “equities market regulatory body” in Malaysia and has made its statement regarding taking action and penalising accused CEOs and directors. “Section 130 of the Companies Act 1965” has made an indication regarding disqualifying the CEO for the conviction of criminal financial offence22facilitates money laundering. Some other regulators are such as “The Ministry of Home Affairs”, “The Financial Services Authority”, The “Companies Commission of Malaysia Attorney General’s Chambers”, “The Ministry of Finance”, and “The Ministry of Internal Security”.

Evaluating Information on the file

As mentioned in the case scenario this can be seen that “Global Metal Trading (GMT)” is a potential client who is seeking to open an account. The Client account-opening file contains some4 pieces of information such as the business activity of the company galls under the dealer section and the company works in the sector of dealing precious metals. The company is based in Malaysia and the head office is located in the capital city Kuala Lumpur. Two directors of the company are John Ma and CK Lee and both hold citizenship in Malaysia. A service provider present in Labuan has done the registration process made for the company. The ownership structure of the company is complex and gathering other information regarding the ownership is difficult. Besides the file has the inclusion that the company is only for three years in the business though is making a huge turnover at the end of the financial years and now the company is seeking an investment of RM50 million for further development.

Determining the Customer Due Diligence (CDD)

Defining CDD

CDD is a process for making identification and substantial verification for making identification of customers. The reporting institutions are responsible for crosschecking a few information of the clients in order to check the reliability and validity before the investment process. In this aspect, CDD includes

- The identification of the customers

- Identification of the beneficial owners

- Identification of that person who has involvement in making the transaction

- The purpose of the transaction

Analysing the specific time for making CDD

The CDD is being made in some specific scenarios and they are as there is any possibility of making any new business relationship with a new client or proceeding with occasional transactions or nay-new transaction with an unknown client. Besides, this includes cases like money laundering or terrorist funding activities or various doubts regarding inadequate and inaccurate financial documents there must be the possibility of making CDD.

Analysing the types of CDD

CDD are of two types simplified CDD and Standard CDD. Simplified CDD is performed in low-risk situations while standard CDD is performed in high-risk situations.

Simplified CDD

In Simplified CDD, “Money Service Business(MSB)”, “designated Islamic Payment Instruments(NBI)”, and financial institutions are responsible for making identification of information like full name, NRIC card number, passport number, mailing and residential addresses, DOB and nationality.

Standard CDD

Standard CDD is made for beneficial owners well as individual customers. Where the reporting institutes are responsible for checking details as mentioned in simplified CDD along with some other information like business registration number, registration address, shareholders’ and directors’ background, and authorised personality for representing the enterprise.

Analysing the process of verification

Verification of the documents is done once all required information gets collected. The process of verification completely depends on the type of the customer and the money laundering risk associated with that client. If the situation comprises a higher risk factor then either two situations get analysed such as the customer is involved in “Politically exposed Persons (PEP) or the transaction is involved with “higher risk jurisdiction”. PEP is those personnel or a company who has direct involvement with international organisations or Govt. body from Malaysia or some foreign country. Foreign PPE at the risk of money laundering is treated as high-risk customers. The risk is being assessed through standard CDD. On the other hand, Higher Risk Jurisdiction makes an indication as mentioned by “The Financial Action Task Force FATF” is some countries that display a risk of money laundering or terrorist activities.

Analysing the overall area before onboarding the client

As per the current scenario “Global Metal Trading (GMT)” is a company based in Malaysia and the company has its head office in Kuala Lumpur. The company has made the registration from a service provider located in Labuan. However, the data provided by the company regarding ownership is not clear and tracking such things is very difficult. In this aspect, the company are going to be analysed under the High-risk factor. Besides, the companies operating area is in dealing with precious metals. In this scenario, the bank issues specific CDDs. Three specific factors are being checked such as

- Whether GMT has involvement in selling other goods by DPMS and is not seeking to sell precious metals.

- For a single purchase, how does GMT has the involvement in doing aggregate payments over a period of time

- This is going to be found whether the company has involvement in buying or selling of precious metals.

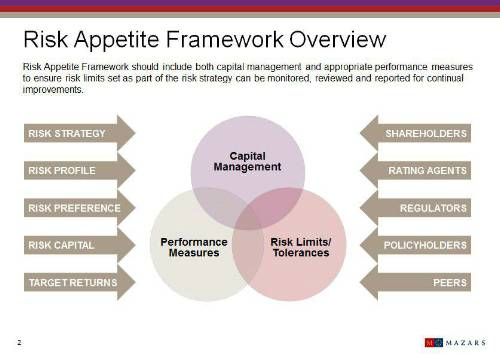

Figure 1: Risk appetite Framework

(Source: amlcft , 2022)

Evaluating all issues and risks for the firm

As per the scenario, the firm GMT is associated with certain risk factors and they are

- The company has a problem regarding their complexity in the ownership and tracking the details is difficult

- The financial documents provided by the company is not valid

- One of the two directors associated with the company named GMT is a “Politically exposed Persons (PEP)”.

- The company is dealing with precious metals.

- Despite the age of the company is just three years the company is making a huge turnover.

- The company is seeking an amount of RM50 million investments.

Based on the above factors “section 4(1) of the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLATFA)” represents the client is making a transaction in which the counterparty is unrecognizable or has any valid information besides the client is showing reluctance in providing valid documents and an unrequited use of an intermediary in the transaction. Besides CK Lee, one of the directors is an ex-politician of Malaysia that makes him a candidate for “Politically exposed Persons (PEP), and this indicates that he is also a “beneficial owner” On the other hand, the company is seeking more than RM5000. Based on these factors the company named “Global Metal Trading (GMT)” will be put at high risk. As mentioned in Recommendation 12 the PPE can take anti-corruption safeguards with the help of opening new accounts and such way-making establishment of anti-corruption safeguards. In this scenario, PEP’s status as one of the directors is positive. In this aspect,

Considering other potential risk factors as explained in “Recommendation 10” by “FATF Guidance Politically Exposed Persons” that is based on 2013 legal arrangements or legal entities. The risk is that there is a high possibility that corrupt “Politically exposed Persons may have utilised legal entities in order to conceal their identity as the beneficial owners.

Analysing the current risk appetite displayed by the board

In Malaysia, there is an offshore financial centre in Labuan. This is being rated as medium risk in the NRA. A considerable number of financial intelligence is operated in Labuan are owned by a large consonance of businesses. This has been seen that the offshore sector of Malaysia has exposure to “high-risk jurisdiction”. These commercial, institutional, and cross-border linkages posses the risk of money laundering and terrorism activities, under this scenario, certain red flags may make an indication of the risk of money laundering. As a result, the firm can face several riasks such as negative publicity and damage to the overall reputation in the corporate world. Besides, there is a possibility of regulatory and legal sanctions. In that scenario, GMT can get involved in the process of remitting black money abroad with the help of the banking system or they can utilise the account for making the withdrawal of that black money. In this scenario, the Anti Money Laundering suite can be used by the board in order to make identification of the ap[petite delayed by the board.

Figure: Risk appetite Framework

(Source: actuarialpost , 2022)

Foreign PPE at the risk of money laundering is treated as high-risk customers. The risk is being assessed through standard CDD. On the other hand, Higher Risk Jurisdiction makes an indication as mentioned by “The Financial Action Task Force (FATF)” is some countries that display a risk of money laundering or terrorist activities. The “Risk Appetite framework” makes an indication about making appropriate balance regarding risk factors and reward system by maximizing shareholderv returns.

Conclusion

In this study, two different case study has been analysed related to AML where John is a newly appointed AML analyst and he has the responsibility of making reports based on suspicious activity and suspicious transactions though these activities are not clear to him. In that scenario, this has been seen that “Bank Nagara Malaysia”, the central bank of Malaysia holds the authority of making investigations of money laundering cases. This bank is responsible for making investigations based on the four laws associated with this such as “Financial Services Act 2013”, “Islamic Financial Services Act 2013”, “Money Services Business Act 2011” and “Development Financial Institutions Act 2002.

Some case scenarios have also been identified like money laundering through cash or some other means. For giving a real scenario, the case of “Genneva Malaysia Sdn Bhd” and “the case of Hamimah” has been discussed. This has been found that lawyers are the legal means of making obligations about suspicion of financial intelligence via STR. On the other hand, “Global Metal Trading” and make an evaluation of “Customer Due Diligence”. The company holds high-risk factors and certain risks concerning their substantial complexity in the ownership details and based on their operational area in dealing with precious metals.

Reference List

lawsociety , 2022, Suspicious activity reports viewed from

https://www.lawsociety.org.uk/en/topics/anti-money-laundering/suspicious-activity-reports

fiubelize, 2022, Types of Suspicious Activities or Transactions viewed from

https://fiubelize.org/types-of-suspicious-activities-or-transactions/

bnm, 2022, Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (Act 613) viewed from

commonlii, 2022, Malaysian Legislation viewed from

http://www.commonlii.org/my/legis/consol_act/ala2001223/

ccid, 2022, ANTI-MONEY LAUNDERING AND ANTI-TERRORISM FINANCING ACT 2001 viewed from https://ccid.rmp.gov.my/Laws/Anti_Money_Laundering__Anti_Terrorism_Financing_Act_2001.pdf

bnm, 2020, Genneva Malaysia Sdn Bhd including Eight Individuals and Two Other Companies Found Guilty to Illegal Deposit Taking and Money Laundering Charges viewed from

Latif, A.M.A. and Abdul-Rahman, A.I.S.Y.A.H., 2018. Combating money laundering in Malaysia: current practice, challenges and suggestions. Asian Journal of Accounting and Governance, 10, pp.123-134 viewed from

Unodc, 2022, THEMATIC COMPILATION OF RELEVANT INFORMATION SUBMITTED BY MALAYSIA viewed from

moha , 2022, Anti-Money Laundering and Anti-Terrorism Financing Act 2001 viewed from https://www.moha.gov.my/images/maklumat_perkhidmatan/membanteras_pembiayaan_keganasan/AMLATFA.pdf

amlcft, 2022, Reporting to Bank Negara Malaysia viewed from

https://amlcft.bnm.gov.my/reporting-to-bnm

Hamin, Zaiton & Omar, Normah & Rosalili, Wan & Kamaruddin, Saslina. (2018). Reporting Obligation of Lawyers under the AML/ATF Law in Malaysia. Procedia – Social and Behavioral Sciences. 170. 409-414. 10.1016/j.sbspro.2015.01.001. viewed from https://www.researchgate.net/publication/276929204_Reporting_Obligation_of_Lawyers_under_the_AMLATF_Law_in_Malaysia

Amlcft, 2022, Customer Due Diligence (CDD) viewed from

https://amlcft.bnm.gov.my/faq/dnfbps-nbfis/cdd

actuarialpost , 2022, viewed from

https://www.actuarialpost.co.uk/article/risk-appetite—-business-decisions-5154.htm

amlcft , 2022, What is Money Laundering? viewed from

https://amlcft.bnm.gov.my/what-is-money-laundering

legislation, 2022, Proceeds of Crime Act 2002 viewed from

https://www.legislation.gov.uk/ukpga/2002/29/contents

bi, 2022, Introduction to AML/CTF viewed from

Sc, 2022, EXAMPLES OF SUSPICIOUS TRANSACTIONS viewed from

https://www.sc.com.my/regulation/guidelines/amla/examples-of-suspicious-transactions

unodc , 2022, PREVENTION OF MONEY-LAUNDERING viewed from

imf, 2022, Financial Intelligence Units viewed from

https://www.imf.org/external/pubs/ft/FIU/fiu.pdf

ssm, 2022, COMPANIES ACT 1965 (REVISED – 1973) viewed from

https://www.ssm.com.my/acts/fscommand/CompaniesAct.htm

fatf-gafi, 2022, Who we are

https://www.fatf-gafi.org/about/

deloitte, 2022, Money laundering: Risks you cannot ignore viewed from

fatf-gafi, 2022, Anti-money laundering and counter-terrorist financing measures – Malaysia viewed from

fatf-gafi, 2022, politically exposed persons(recommendations 12 and 22) viewed from